While Others Seek to Inject CO2, Airgas Sells It

by Debra Fiakas CFA Just one of the many suppliers of industrial and commercial carbon dioxide, Airgas, Inc. (ARG: NYSE) recently announced plans to build a new carbon dioxide plant in Houston. The press release hit news wires right along with announcements of carbon capture projects and other investments to reduce greenhouse effect from too much CO2 in the atmosphere. In one those strange twists that makes our world so interesting and vexing at the same time, is the fact that we use carbon dioxide all the while we invest wildly to reduce CO2...

OriginClear Gambles on Marketing Program

by Debra Fiakas, CFA

Last week waste water treatment developer OriginClear (OCLN: OTC/QB) announced pilot projects for rental of its commercial water systems for pool cleaning. The company has several patents to its credit, protecting its innovations. OriginClear has developed a proprietary catalytic process to clean up solids from waste water as well as an oxidation technology to eliminate microtoxins in water. Unfortunately, the company has struggled to extract value from its efforts. OriginClear has yet to report profits. Indeed in the most recently reported fiscal year ending December 2019, revenue of $3.588 million only barely covered cost of goods of $3.217 million, let alone operating expenses that...

Plasma Arcs For Pig Waste

This week MagneGas (MNGA: NASDAQ) announced new work completed toward plans to enter the commercial pork sector with a proprietary manure processing and disposal solution. Management held a meeting with the North Carolina Department of Environmental Quality and the U.S. Army Corps of Engineers to discuss MagneGas technology to treat agriculture waste and the state’s required environmental permit protocols. MagneGas aims to sell to pig farmers equipment based on its innovations.

The company wants to help pig farmers address environmental problems cause by manure accumulation with its proprietary waste sterilization process. Handling pig waste using conventional methods can be costly, but failure to...

List of Pollution Control Stocks

Pollution control stocks are publicly traded companies whose business involves technologies for removing or reducing the emissions of harmful pollutants, contaminants, and/or waste from human activity, or removing these pollutants from the environment or water.

This article was last updated on 6/25/2020.

Advanced Emissions Solutions, Inc. (ADES)

Advanced Disposal Services (ADSW)

Babcock & Wilcox Enterprises, Inc. (BW)

Bion Environmental Technologies (BNET)

Biorem Inc. (BRM.V, BIRMF)

Casella Waste Systems (CWST)

CECO Environmental Corp. (CECE)

CDTi Advanced Materials, Inc. (CDTI)

Clearsign Combustion Corp. (CLIR)

CO2 Solutions, Inc. (CST.V, COSLF)

Donaldson Company, Inc. (DCI)

Ecolab, Inc. (ECL)

EcoSphere Technologies, Inc. (ESPH)

Euro Tech Holdings (CLWT)

Fuel Tech (FTEK)

iPath Global Carbon ETN (GRN)

OriginClear (OCLN)

Pacific Green Technologies Inc. (PGTK)

Republic Services,...

Greenhouse Gas Management Stocks: Key To A Real Climate Change Portfolio?

There has been a lot written lately about how to turn climate change into an investment opportunity, including on this site. Not all of it is, however, especially useful or relevant. In the worst cases, commentators have ascribed the 'climate change investment opportunity' label to just about any industry out there, indiscriminate of whether or not there really is a strong and direct connection. If you are seriously interested in playing the climate story, you should stay focused on near and medium term opportunities with real and tangible links to what is currently going on with the climate...

Phycal Captures CO2 Funding for Biofuel

by Debra Fiakas CFA As part of its program to promote beneficial reuse of carbon dioxide, the Department of Energy awarded a total of $27.2 million ($3.0 million in the first phase and $24.2 million in a second phase) to a consortium led by alternative energy developer Phycal, Inc. (private). According to the DOE website, Phycal is to develop an integrated system to produce biofuel from microalgae cultivated with captured carbon dioxide (CO2). The biofuel is to be blended with other fuels for power generation or as drop-in diesel or jet fuel. It is a bit of...

A Concrete Proposal

The Economist recently had a story on how the cement industry is beginning to confront the fact that the industry produces 5% of the world's emissions of greenhouse gasses. Carbon dioxide is emitted not only by the fossil fuels used to create the heat used in the creation of cement, and by the chemical reaction in that process. Unfortunately for us, cement is a remarkably useful building material, not least as a structural material which can also serve as thermal mass in passive solar buildings. All the large cement firms: Lafarge, Holcim, and Cemex (NYSE:CX) have joined a voluntary...

The EPA’s Carbon Rule: Likely Stockmarket Winners

By Harris Roen Greenhouse gas emissions by economic sector A seismic shift in the power generation landscape is starting to sink in. It has been two weeks since the EPA announced its new proposed carbon rules, one of the flagship efforts of the Obama Administration to address climate change. This shift is meant to move the country in the direction of inevitable changes coming to the energy economy. It is important for investors to know which companies and sectors stand to benefit from the...

Southern Company’s Carbon Capture Testing

by Debra Fiakas CFA Coal emissions photo via BigStock An electric utility of Southern Company’s size - $38.3 billion in market capitalization - is not among the typical company covered in the Small Cap Strategist weblog. Southern (SO: NYSE) owns and operates six dozen power plants in the southeastern U.S., generating 12,222 megawatts of power from a mix of fossil fuel, hydroelectric, nuclear and solar plant assets. The company earned $2.68 in earnings per share on $16.5 billion in total electric power sales. Sales dipped in 2012...

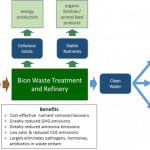

Bion: Waste To Dollars

Earlier this week Bion Environmental Technologies (BNET) received approval of a patent for its proprietary ammonia recovery process. Bion’s technology converts livestock wastes into ammonium bicarbonate. Patent protection in the U.S. paves the way for Bion to deliver an environmentally friendly chemical to the market at attractive profit margins.

Ammonium bicarbonate is used for a variety of purposes from leavening to crop additives. It is the fertilizer market that has caught Bion’s attention. The company intends to ‘close the loop’ for the agricultural sector by helping livestock producers economically dispose of waste and then delivering a fertilizer for food crops that qualifies as organic.

It is an attractive...

Earnings Roundup: Metals Prices Boost Covanta and Umicore

By Tom Konrad, Ph.D., CFA

You don’t have to own mining companies to benefit from rising metals prices.

This is a roundup of first quarter earnings notes shared with my Patreon supporters over the last week. Waste to energy operator Covanta and specialty metals recycler Umicore are both benefiting from skyrocketing metals prices.

Just as renewable energy and energy efficiency stocks have long shown that investors don’t have to own fossil fuel companies to benefit from rising prices of fossil fuels, recyclers like Covanta and Umicore are showing that you don’t have to own environmentally damaging mining companies to benefit from rising...

Tetra Tech’s Two-Penny Disappointment

by Debra Fiakas, CFA

Tetra Tech’s (TTEK: NASDAQ) quarter earnings report last week was met with high drama as traders reacted with surprisingly vehement disappointment over the recent financial performance of the engineering and technology business. The company’s stock price gapped down in the first day of trading following the announcement, falling through a significant line of price support. The shares continued to fall and finished the week at a price not seen since mid-April 2017 before the stock began its recent drive higher.

The drama unfolded after Tetra Tech reported net earnings of $0.52 per share on $498 million in total...

The Worst Waste

Jim Lane Peter Brown of FFA Fuels, promotes his company these days with the pithy slogan, “Fuels from the Worst Waste Around.” Which of course raises the legitimate question, what is the worst waste, and can we find a use for it? Discussions of worst waste will usually focus on the obvious say, landfill or the odious say, medical or nuclear waste. Toxicity and longevity are typical concerns, and that’s one of the reasons why nuclear energy remains controversial to this day. No Waste in Nature As LanzaTech’s Jennifer Holmgren observed in a recent article by...

Water Out Of Thin Air

It is an irony that surrounded by the flood waters of Hurricanes Harvey and Irma, a drink of fresh, clean water may be hard to come by. Of course, the all three levels of government make plans for stockpiling and deploying emergency bottled water well ahead of natural disasters. Yet in the hours and days following the worst of both the recent storms, the media was filled with stories of people who lacked water.

What if water could be made manufactured? If such a technology existed, what a boon it might be to thirsty storm victims.

Ambient Water Corporation (AWGI: OTC/PK) has...

Ten Insights into Carbon Policy and Its Implications

On November 27, I attended the National Renewable Energy Laboratory's (NREL) Fifth Energy Analysis Forum, hosted by NREL's Strategic Energy Analysis & Applications Center. The forum focused on carbon policy design, the implications for Renewable Energy and Energy Efficiency. As a stock analyst focused on that sector, I am extremely lucky to have NREL as a local resource: the quality and the level of the experts at NREL and the ones they bring in is probably not matched anywhere in the country, and conferences like these provide priceless insights into what these Energy Analysts are thinking. Why should investors...

Mantra’s Promise of Innovation

by Debra Fiakas CFA How often do we see the crowd rooting for the underdog? You could hear the cheers for Mantra Energy (MVTG: OTC) last week at the Marcum Microcap Conference in New York City. Mantra is a developmental stage company pursuing technologies to harness carbon dioxide for energy. Of course, the company has no revenue and therefore no earnings. Indeed, its technologies are so unique and as yet at such an early stage some might find them almost fanciful. Yet for some investors, a fanciful underdog is even better than another. Mantra sees itself...