ESG5 Summit brief

A conference hosted in NYC in early April, 2019 ESG5 SUMMIT showcased the issues of current concern to institutional asset managers. ESG as a term is a rebranding of SRI (socially responsible investing) and CSR (corporate social responsibility) now under broad headings of Environment Social & Governance, to reflect that it is more than just an investing style, but is concerned with risk management and value creation. ESG strategies are being pursued by a range of participants, including public and private pension funds, mutual funds and ETFs, family offices and sovereign wealth funds, and advisors and advocacy groups.

The goals are...

Why Investing Should Be Moral

Last night, a recent finance graduate introduced himself to me, telling me he had attended my presentation at the Colorado Renewable Energy Society on July 24th. (the whole presentation is available after the link, scroll down to Jul 24.) He said he wasn't invested in clean energy because "Investing is about making money... there's nothing moral about it." I'm sure I was quite sarcastic when I replied, "That sounds like a finance major." I believe that finance and economics, as they are currently taught, make people less moral. I'm not talking about God. I'm personally agnostic with tendencies towards...

Next Economy and Faith for Empiricists

Garvin Jabusch Let's be clear: Justice is not an immutable law of nature. Neither math nor physics nor chemistry recognizes justice as one of the universe's governing principles. The strong, rich, and powerful have, since long before humans emerged, by and large taken what they wanted, when they wanted, and never counted the costs to those they took it from. Despite what Socrates may have said, justice has forever occurred, at best, in fleeting, ephemeral flashes. We yearn for a god capable of seeing and ultimately judging all rights and wrongs because we know we can't be counted...

Why Oil & Shipping Firm A.P. Moller-Maersk and Steelmaker POSCO Are ‘Green’ Investments

by Bill Paul There's no such thing as an "experienced" alternative energy investor. The sector simply is too new. Also, like an iceberg, most of it lies hidden beneath the surface. To succeed in these uncharted waters, I believe that alternative energy investors (a group that eventually will include all investors) need to follow a particular set of guidelines that I've started identifying in recent articles. The first guideline is that you must be a long-term investor with a time horizon of at least three to five years. Otherwise, you'll miss out on most of the incredible financial payoff...

Interview with Tom Konrad on the CleanTech Show

An interview with our analyst, Tom Konrad, with Nick Bruse of The Cleantech Show is now available. In it, they discuss various strategies and the outlook for the Cleantech investment space, as well as some of Tom's ideas on industry regulation. You can download or listen to a podcast of the interview here.

Scrappy Companies For Scrappy Investors

By Tom Konrad, Ph.D., CFA

Supply and Demand

One uncomfortable fact for green investors is that the clean energy transition is going to require a lot more mines. Lithium, nickel, cobalt, copper, manganese, graphite, even steel: just name and industrial commodity, and we’re probably going to need a lot more of it.

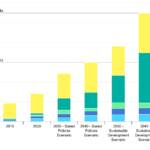

Total mineral demand for clean energy technologies by scenario, 2010-2040

Even worse, it’s not at all clear where all these materials are going to come from. While there are plenty of all the elements we need in the Earth’s crust, actually mining them all in the next 20 years is not...

Can America Regain the Rare Earths Crown?

by Kidela Capital Group A rare earth element is like air. It only seems to become important when you are running out. With China suddenly cutting back on exports while controlling 95 percent of the world’s production of rare earth elements, the United States and other countries suddenly finds themselves vulnerable. This vulnerability has to do with the stability of the supply of these strategic commodities. Countries from around the world have suddenly woken up to the realization that the future of their high technology industries could be in the hands of one supplier – China. In the...