Tom Konrad CFA

Will Chinese hybrid bus subsidies be renewed? The answer will be crucial for Maxwell Technologies (NASD:MXWL) in the coming months.

I, and most analysts following ultra-capacitor manufacturer Maxwell Technologies, (NASD:MXWL) were considerably surprised at the strength of its third quarter earnings. China had failed to renew subsidies for hybrid buses in the third quarter, and Chinese hybrid bus manufacturers have long been a significant part of Maxwell’s business.

Hybrid bus sales, even without subsidy, ended up better than I expected, accounting for 30% of Maxwell’s ultra-capacitor sales in the quarter. Also helping results were strong ultra-capacitor sales to the wind industry (25%) and a large contribution from their distribution channel (22%.)

Going forward, sales from the distribution channel will be falling, as this is previously deferred revenue from Maxwell’s recent earnings restatement. $3.9 million of deferred revenue remains in this channel, most of which is likely to be recognized in the fourth quarter, but significantly down from this quarter, when it amounted to $11.3 million.

China Hybrid Bus Subsidies

The big question mark for the fourth quarter is when and if Chinese hybrid bus subsidies are renewed.

This renewal has been expected for some time, but the Chinese government clearly marches to its own tune. China did release its “New Energy Vehicle” subsidies in September, but these did not include subsidies for hybrid buses. According to a 2009 World Bank report on electric vehicles [.pdf], New Energy Vehicles were previously defined as “vehicles that are partially or fully powered by electricity.” But the new program includes only fully electric vehicles (EV), plug-in hybrid electric vehicles (PHEV), and Fuel Cell vehicles (FCV).

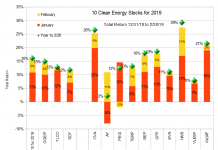

My estimates of Maxwell’s revenues and earnings per share with and without renewal of Chinese hybrid bus subsidies.

Maxwell’s bus manufacturing customers expect that hybrid subsidies will be released separately. The catch is, these subsidies have been expected for months, and the delay is leading many investors to question if they will be released at all. As you can see in my projections above, the impact of subsidy renewal on Maxwell earnings and revenues is likely to be significant. If the subsidies are not renewed soon, Maxwell’s management is predicting that total revenues could fall 30% ($16 million) in the fourth quarter, although approximately $7-8 million of that decline is likely to come from falling ultra-capacitor sales through the distribution channel.

While I don’t have any special insight into the Chinese government’s plans, the impetus for the new energy vehicle and hybrid subsidies is two-fold. The goal is partly to combat China’s horrible urban pollution problem, and partly to foster Chinese leadership in what they consider an strategic industry. When it comes to assessing the likelihood of renewal for the hybrid subsidy, cleaning up air pollution is likely to be helped more by hybrid subsidies than the existing PHEV subsidies alone. On the other hand, when it comes to nurturing new industries, the current subsidies for PHEVs, EVs, and FCVs are likely to be more effective than a renewed subsidy for hybrids.

Hybrid subsidies are more effective at reducing pollution because hybrid vehicles are typically much more cost effective. While each PHEV could reduce local pollution twice as much as a hybrid would, some of that pollution reduction would simply be moved from the city where the bus is operating to the coal plant which generates its power. Further, the incremental cost of a hybrid is a fraction of the incremental cost of a PHEV, so many hybrids could replace conventional buses for the same cost as a few PHEVs.

On the other hand, hybrid technology is fairly mature, and a foreign company (Maxwell) is the leading supplier of the crucial untra-capacitors for hybrid buses. In contrast, PHEV buses will use a large number of batteries, and China has many leading battery manufacturers, meaning that China is more likely to favor subsidies (such as those for PHEVs) which help the battery industry than the ultra-capacitor industry. Further, PHEV and EV technology is still developing, so China is likely to have an easier time becoming a leader.

With these countervailing forces, I find it impossible to predict when or if China’s hybrid subsidies will be renewed. Given this uncertainty, I have closed out my short position in the stock.

Analyst Reaction

Several of Maxwell’s analysts are much more confident than I am that subsidies will be renewed. Since the earnings announcement, Ardour Capital and UBS have both upgraded the stock from “Hold” to “Accumulate.” I can’t imagine they would have made these upgrades if they did not expect hybrid subsidies to be announced soon.

It also may be that, if the analysts are more familiar with ultra-capacitor technology than hybrid vehicle and PHEV technology, they could expect that Chinese PHEV buses could go a long way to replacing lost revenue from Chinese hybrid buses.

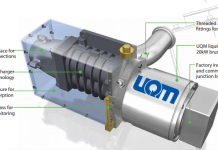

Maxwel Technologies’ Product Portfolio

|

The Difference Between Hybrids and PHEVs

In the quarterly conference call, Maxwell’s COO and interim CEO, John Warwick painted the PHEV bus opportunity with an optimistic brush. To create the first generation of PHEV bus, Maxwell’s customers are “basically taking the diesel hybrid using ultra-capacitors and adding a battery power to it for propulsion for the first 30 plus kilometers.” Hence, each first generation PHEV bus will use the same number of ultra-capacitors as a hybrid bus.

He did not discuss what the second generation might look like, most likely because they are likely to require fewer ultra-ca

pacitors. The reason hybrid buses use ultra-capacitors rather than batteries is because batteries have low power, but high energy capacity: While batteries can hold a lot of charge, they are not very good at delivering and accepting a large amount of charge in a short period. The large mass of a bus means that much of the energy recovered while braking would be wasted if it had to be absorbed by a reasonably sized battery pack for a hybrid.

In contrast, ultra-capacitors have high power but low energy capacity. They absorb and discharge electricity quickly, but can store very little of it. This makes ultra-capacitors suitable for a hybrid bus, but not for a PHEV bus. A PHEV needs to store a significant portion of its fuel as electricity so requires a large battery pack.

Although batteries have low power capacity on a unit basis, the large bank of batteries required by a hybrid bus will still be able to deliver and absorb a significant amount of power in a short time. This means, as manufacturers seek to cut the cost without sacrificing the performance of future PHEV buses, it will be relatively easy to significantly reduce the number of ultra-capacitors per bus. Depending on the type of batteries used, it’s quite possible that a PHEV bus will require no ultra-capacitors at all. American start-up ePower has developed a hybrid drive-train suitable for class 8 diesel trucks using only lead-carbon batteries from Axion Power (OTC:AXPW.) BAE Systems (LSE:BA) sells a hybrid bus drivetrain using only lithium-ion batteries. Allison Transmissions (NYSE:ALSN) has been selling hybrid bus drivetrains since 2003 using nickel-metal hydride batteries. If ePower, BAE, and Allison do not need ultra-capacitors to make a bus-sized hybrid work, surely Chinese companies can do the same with a PHEV bus.

One other reason PHEV buses are unlikely to replace hybrid buses for Maxwell is simply the size of the market. Given the higher cost of PHEV buses arising from the large battery pack, fewer PHEVs are likely to be sold, even under the new subsidy regime.

Conclusion

If Chinese hybrid bus subsidies are renewed in the near future, I expect Maxwell’s stock to rise rapidly because of its much improved near term prospects. While I’m far from certain that this will happen soon, if ever, I feel the chance is significant. Therefore, I decided to close my short position in the stock.

Going forward, the very real possibility of no hybrid subsidy renewal makes me unwilling to recommend the stock, either. If I were to have any position, it would be to bet on a big move in one direction or the other with long calls or puts.

This article was first published on the author’s Forbes.com blog, Green Stocks on October 31st.

DISCLOSURE: No Position.

DISCLAIMER: Past performance is not a guarantee or a reliable indicator of future results. This article contains the current opinions of the author and such opinions are subject to change without notice. This article has been distributed for informational purposes only. Forecasts, estimates, and certain information contained herein should not be considered as investment advice or a recommendation of any particular security, strategy or investment product. Information contained herein has been obtained from sources believed to be reliable, but not guaranteed.