Charles Morand

This is the third installment of my review of the book book “Investment Opportunities for a Low Carbon World“. The second installment covered geothermal power and energy efficiency and the first installment covered wind and solar.

This post reviews three interrelated chapters on the world of cleantech and alt energy indices, funds and ETFs. Two of these three chapters are my favorite in the book so far – they provide very useful information for the novice investor with an interest in alt energy investing but limited time and knowledge for successful stock picking.

Cleantech and alt energy are challenging sectors to invest for several reasons: (1) pure-plays tend to be risky investments because substantial technology and business risks often exist; (2) when pure-plays are not so risky (i.e. wind power), stocks tend to trade at outrageous multiples, with several years of strong growth already fully priced in; (3) the stocks of non-pure plays with some exposure to alt energy trade, more often than not, based on what happens in other parts of the company, requiring investors to own businesses they might have little interest in or understanding of (e.g. General Electric (GE) and Siemens (S)).

The alternative to equities is to invest in one of the alternative energy and cleantech ETFs (either long or short) or purchase one of the alt energy mutual funds. I generally believe the latter option to be less desirable than the former, mostly because of high expense ratios and other fees. ETFs, in my view, provide an excellent way for retail investors to gain exposure to the sector – although overpricing and volatility issues still exist, firm-level risk is eliminated and risk is spread over a large number of securities at a relatively low cost.

Measuring the Performance of Environmental Technology Companies

David Harris, FTSE Group

This chapter provides an introduction to cleantech and alt energy stock indices. Early on in the chapter, the author notes:

“Active managers claim they can identify those companies with above market average growth potential, but at this stage in the sector’s evolution it is impossible to know which environmental technology companies will be the winners”

While I don’t think this assessment applies equally to all sub-sectors of the environmental technology market, this statement still sums up relatively well the landscape for most retail investors and, as mentioned above, provides a strong argument for index-based investing.

The chapter then moves on to provide a methodology for breaking down the environmental technology sector into sub-sectors, based on the approach used by FTSE in making its Environmental Technology Index Series. It then lists out the main environmental technology indices available and their key characteristics.

Overall, this is a useful chapter for investors in understanding how index makers approach the process of index creation. Since indices form the backbone of ETFs and are the single most critical determinant of ETFs’ relative performance, this is a process worth understanding. However, the author could have provided more technical information to increase the chapter’s usefulness to investors with an intermediate level of knowledge.

Investment Approaches and Products for Investors

Clare Brook, WHEB Asset Management

This chapter provides a review of the following investment vehicles: socially responsible (SRI)/ethical funds, cleantech mutual funds, private equity cleantech funds and environmental hedge funds.

We learn that the largest holdings in most ethical/SRI funds are often in industries unrelated to environmental tech such as financial services. That is because such funds, unlike cleantech and alt energy mutual funds, do not invest in anything specific – they merely avoid investing in companies and industries that violate pre-determined ethical standards. For cleantech investors, those funds are generally useless.

As far as real cleantech and alt energy mutual funds go, the author discusses the problem of over-valuation mentioned above – in her view, valuations often reflect more a scarcity of investment options in pure-play cleantech stocks than realistic expectations for future growth.

The criteria provided by the author to evaluate different investment options are the most part of this chapter. The one thing that the author stresses across different actively-managed investment products is the quality of the management team, its experience and its track record. I would tend to agree – if someone decides to invest in mutual funds, these factors should arguably weigh more than the expense ratio, as they help put the expense ratio into perspective.

Exchange Traded Funds as an Investment Approach

Lillian Goldthwaite, Friends Provident

This chapter provides a detailed overview of ETFs and makes the case well for using them in a portfolio. I particularly liked this chapter.

According to the author, some of the main strengths of ETFs are: they are traded on exchanges and can be bought and sold (and priced) throughout the day; they can be sold short, bought on margin and loaned; the portfolio can be viewed in its entirety at all times and the index construction process is transparent; and the process by which institutional investors can acquire and redeem shares by trading in the stocks of companies in the index ensures that no sizable gap emerges between net asset value and portfolio value.

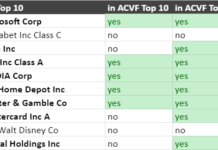

As with the previous chapter, the author provides a checklist of items to research when doing the due diligence on an ETF. The chapter concludes with a list of ETFs in cleantech and alt energy, but also in nuclear energy, carbon emissions, timber and water.

The author does not delve particularly deep into cleantech per se, keeping the discussion focused instead on ETFs more generally.

Overall, I found this chapter interesting and quite useful. As is the case with the preceding two, there is less to say about this chapter than there was about the ones on environmental technologies that I reviewed in the first couple of installments,

mostly because these chapters are shorter.

The more seasoned investor is unlikely to learn much from this section of the book. But so it goes for such books in general; they are ideally suited for novice investors who want to get started investing into the sector and want a framework to approach the process.

For those interested in cleantech and alt energy ETFs, the following articles might be of interest:

Wind

Solar

General alt energy and cleantech

Carbon emissions

DISCLOSURE: None

* We are always interested in reviewing books and reports in the areas of alternative energy, cleantech or other environmental industries, especially where they add value to the investment decision-making process. If your organization would like a new book or report reviewed, please contact us.